Features of accounting in Estonia

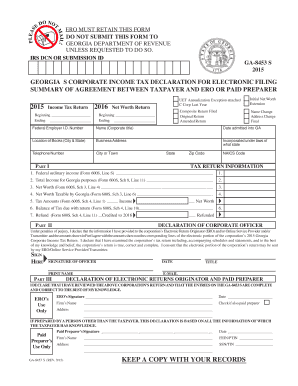

All documents can be stored electronically. There are no strict requirements for processing the company’s internal documents. Reports to the tax department are submitted through the electronic system or on paper (if the company does not have VAT). As a rule, two types of reports are submitted: TSD - to the 10th of each month (about wages and payments), and VAT - to the 20th of each month. Annual report submitted by 30 June of the following reporting year. New companies submit annual report for the first time 18 months after their registration.

The main types of accounting services

Verification and processing of primary documents. Major equipment transaction warehousing. Personnel accounting and pay calculation. Reporting to the Inland Revenue Board. If necessary, preparation and submission of additional reports (credit institutions, suppliers, etc.) Annual report writing, consolidated statements, banking activity and drafting treaties, decisions, protocols. Client representation at the Tax Department. Informing insurance companies about pension contributions.

Preparation of the annual report for the enterprise

This is a very important document in the activities of the enterprise, which takes quite a long time to compile. Information on the annual report of the enterprise (the balance sheet of the enterprise, profit report, report on the main assets of the enterprise, annual turnover of the enterprise, labor costs, debts of the enterprise to its suppliers and other important indicators of the company’s activity) can be obtained by anyone in the Commercial Register for a small fee. It can be viewed by your prospective partners before making a decision on the transaction. The annual report of the enterprise must ask the bank when making a decision on the loan.

Estonian taxes

- Profit tax 0%

- 20% income tax

- Social tax 33%

- dividend tax 20/80

- tax on special benefits, gifts and donations

- Insurance and pension benefits

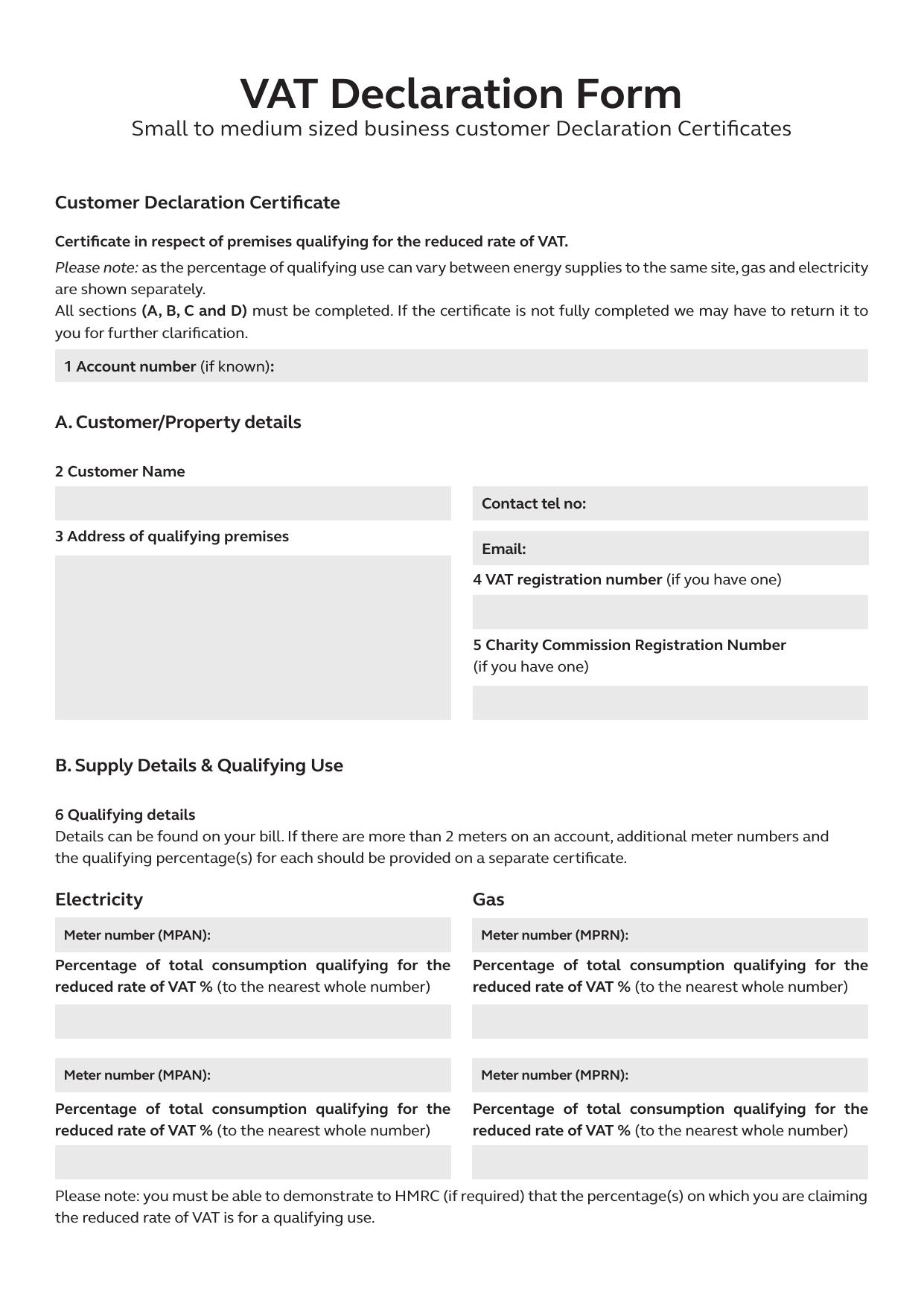

Registration as a person liable for VAT

According to the laws of Estonia, the obligation to register your company as a person liable for sales tax with the Tax Department arises when the taxable turnover exceeds 16,000 euros per year. In this case it is necessary to apply to the Estonian Tax Board for the VAT number. If a person has not already acquired the taxable turnover, or if his taxable turnover has not yet exceeded the limit of 16,000 euros, it is possible to register as a person liable for turnover tax voluntarily. Estonia is a convenient transit area for various types of commercial transactions. If the company provides services or sells goods outside Estonia, they are not subject to turnover tax, which are submitted to the Tax Department. If the company buys and sells goods outside Estonia, it is not necessary to register as a VAT payer in Estonia. In the framework of the European Directive 2006/112/EC, when two companies from different countries within the EU are taxable and carry out business activities, the VAT rate will be 0%.